Potential Impact of Proposed Tax Legislation Changes on Business Owners

An Employee Stock Ownership Plan (ESOP) has always been regarded as an attractive exit strategy for business owners who are looking to defer capital gains taxes, preserve their legacy, and incent employees through employee ownership.

However, with President Biden’s proposed tax increases on the wealthiest Americans and business owners, an ESOP just got a whole lot more attractive for owners who are considering selling their company.

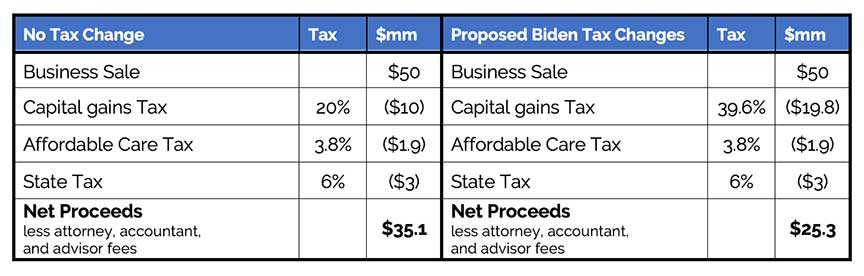

Let’s have a look at the numbers

President Biden’s proposed tax increase could raise capital gains taxes on the wealthiest Americans from 20% to up to as much as 39.6%. Therefore, upon an exit from a third-party sale, most business owners would wind up paying nearly twice as much in capital gains compared to what they would pay today if they sold their business.

The new tax plan would also raise the corporate tax rate on businesses in the United States from 21% to 28%, triggering $1.7 trillion in new tax revenues from C Corporations and another $370 billion from pass-through entities over the next 10 years. Business income tax collections would rise to the highest level in 40 years, according to data from the Congressional Budget Office (CBO).

Furthermore, President Biden has also proposed to phase out the section 199A deduction for individuals making more than $400,000, a 20% pass-through deduction for qualified business income (QBI) available to owners of sole proprietorships, partnerships, S corporations, and some trusts and estates engaged in qualified trades or businesses.

None of President Biden’s proposed tax changes bode well for business owners, but there is no need to panic. If you are considering a sale, the potential tax advantages available through an ESOP might be right the fit for your company.

How can an ESOP provide me with tax advantages if I’m considering selling my company?

Unlike a traditional third-party sale to private equity or a competitor, an ESOP can offer you unique tax advantages. In a third-party sale, if you sold your company for $50 million, you would pay a 20% capital gains tax (which could almost double under President Biden’s proposed tax increases), a net investment income tax of 3.8% (Affordable Healthcare Act), along with the capital gains tax for the state in which you operate your business. We will use 6% for illustrative purposes. Net proceeds to the seller in this scenario are likely around $35.1 million (not including attorney, accountant, and advisor fees). If Biden’s tax plan is passed, a business owner would be looking at around $25.3 million in net proceeds, less fees.

With an ESOP transaction, as long as an owner sells at least 30% of the company to the ESOP and reinvests the proceeds of the sale in other securities, they can defer any tax on the gain. The tax deferment is available through IRC 1042 election and reinvesting the sale proceeds in Qualified Replacement Property (QRP), which is a security issued by a domestic, taxable operating company. The securities can include stocks or bonds and often come with floating-rate notes issued by the company.

The floating rate notes were created specifically for ESOP transactions to meet the requirements of the 1042 capital gain deferral and act as collateral for a margin loan issued by your investment advisor. This means you can invest in floating-rate notes, defer capital gains from the sale for an extended time, and still access up to 90% of the proceeds from your sale. This allows the seller to defer 100% of the capital gains over the rest of their lifetime.

One caveat is that the company will need to be structured as a C Corporation to realize these tax benefits, which can be done prior to the transaction in consultation with a qualified tax advisor and legal counsel.

There are many tax advantages for the company and its employees

- Contributions used to repay a loan the ESOP takes out to buy company shares are tax-deductible.

- Contributions of stock are tax-deductible, so the company gets a current cash flow advantage by issuing new shares or treasury shares to the ESOP.

- A company can contribute cash annually on a discretionary basis and take a tax deduction while using the funds to retire obligations to current owners or to build up future reserves.

- The dividends used to repay an ESOP loan, passed through to employees, or reinvested in company stock are tax-deductible.

- Employees pay no tax on the contributions to the ESOP and can roll over their distributions into an IRA or other retirement plan upon leaving the company.

There are many other benefits and considerations you will need to weigh before deciding if an ESOP is right for you. Owners are encouraged to work with an advisor to understand the range of considerations pertaining to value, current market dynamics, liquidity needs, tax planning, and any qualitative objectives they’d like to achieve in a sale process. Analyzing all these factors may lead an owner to wait and instead pursue near-term opportunities to increase profits while capitalizing on economic trends. Working with a team of economic experts like ITR Economics can further bolster a company’s forecasts and growth plans, and with a 94.7 percent forecast accuracy, they’re one of the best resources available.

If you’re considering selling your business, one of the services we provide to business owners is our feasibility study analysis. This free service helps sellers learn more about the structure and the results for shareholders as well as the potential outcome for management and employees if you were to sell your business to private equity, a strategic buyer, or into an ESOP structure. We use the analysis to help you and your team see what ifs, and the benefits associated with each transaction type.

If you are contemplating your options or looking for a second opinion, click here to learn more about our complimentary feasibility analysis.